Read on below and receive a free copy of Lief Simon’s brand-new e-book…

Learn how to tap into the game-changing

secret of America’s wealthiest families to…

Save Your Future

And Keep Growing Your Wealth…

Through Any Crisis

Dear Reader,

No matter who’s pulling the strings in the White House…

No matter how high taxes rise…

Or how far the stock market falls…

No matter when the next recession strikes—or how hard it hits…

I am not worried.

And you shouldn’t be either…

Because none of that has to affect you.

I’ve already taken effective action…

As I see it, it’s the one-and-only action that’s left for any of us to protect our wealth and freedom through any crisis…

In fact, it’s similar to the strategy America’s wealthiest families have followed for more than a century…

But with an important twist for the times we find ourselves in.

As a Live and Invest Overseas reader—living through some of the most challenging times in our history—I’d like to pass this tried-and-true wealth-building secret on to you…

I’ve laid out exactly what you need to do to crisis-proof your future in my new book, Retire Up–6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown)…

Better yet, I’d like to give a copy of this book today—free.

If you’re worried about the current state of affairs in the world…

If you’re wondering how you—and your nest egg—are going to survive what’s coming down the line…

Then this is the book that will get you through it…

And ensure that you come out the other side of any future crisis with profits in your hand.

Do NOT wait things out and hope for the best…

The worst thing you could do right now is to sit back and do nothing…

Not when you have options. In fact, you have more power over your own future than you know.

My new book is going to show you those options and exactly how to use that power…

Of course, if you’re happy with the status quo…

The IRS’s track record, the state of Social Security, the performance of our politicians, the stability of Wall Street…

My book probably isn’t for you.

But if you’d like to know exactly how you can take control over your own future—come what may—then let’s get down to business…

A Global Crisis Doesn’t Mean A Personal Crisis—Call The Shots On Your Own Future…

We’re living in unprecedented times…

Times so extraordinary that it’s natural to feel powerless. In all the doom and gloom coming from the media, it seems that all you can do is sit tight and wait it out…

At least, that’s what the average Joe will do.

He’ll do nothing but worry about how long this imminent recession lasts and how hard it will hit him…

Which is a waste of precious time.

Because, unfortunately, you can’t control the future of the United States. No more than any single president or government can…

But you can control your own future…

And, right now, you have some important decisions to make…

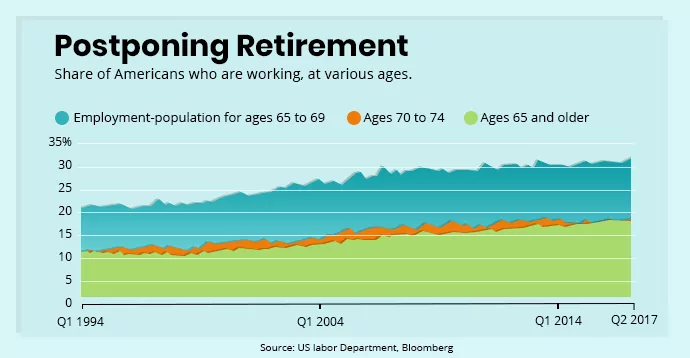

You could keep on working into your late 60s and 70s…

Or—by following the six strategies I’d like to share with you today—you could retire early and give yourself a lifestyle upgrade…

You could let the U.S. stock market decide the future health of your nest egg…

Or you could put your hard-earned cash into less volatile pockets of opportunity… opportunities where your return on investment can be as high as 15% or more a year—way above the S&P average yield of 2%…

You could wait around to see what measures the government may take to tackle the fallout of this current pandemic… and hope that your wealth and your freedom can dodge another bullet…

Or you could organize your affairs so that Uncle Sam has little to no claim on your life savings… and you’re free to live the lifestyle you’ve worked so long and so hard for…

If you’re happy with the status quo, no problem. This plan I’d like to tell you about probably isn’t for you.

But if you’d like to know exactly how you can take control over your own future—no matter what may happen in the United States or in any other part of the world—then let’s get down to business…

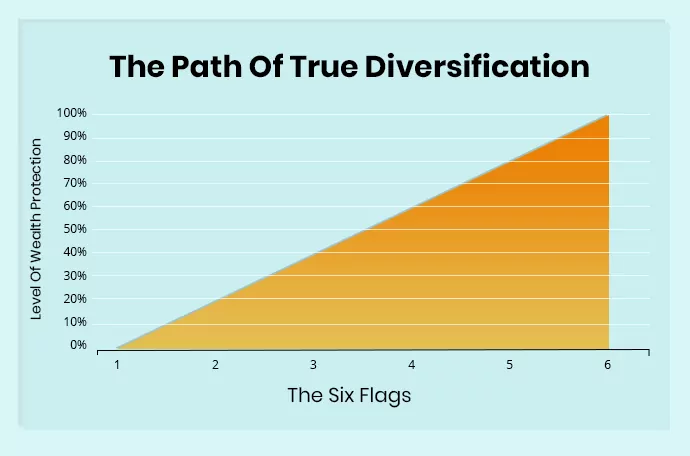

How Diversified Are You?

(I Mean, Really Diversified)…

In this time of global uncertainty, you can’t hang all your hopes on any one country… any one economy… or any one currency.

You need to diversify.

Now, maybe you’ve already taken some steps toward spreading your wealth across different asset classes within the United States…

Maybe you hold some stocks… a little gold or silver… an investment property… or you keep a stash of cash at the ready in case of emergency.

Those are the things that most U.S. financial advisors recommend you do to keep a “diversified portfolio.”

And, that solution may have done the trick a century ago…

Pulling out of the stock markets and into railroads, oil, precious metals, and Hollywood studios is how America’s wealthiest families sailed through the Great Depression.

But that level of diversification isn’t enough to cut it today.

Frankly, if everything you own is tied to the United States and the U.S. dollar, you’re putting yourself and your future at risk.

If you’re familiar with my work, you know where I’m heading with this…

To fully protect yourself and your loved ones in the long term, you need to take your assets offshore.

Or, at least, some of those assets…

Diversifying at an international level means that, come what may, you’ll never have to give up the quality of life you’ve come to enjoy…

Not only that but you could substantially increase your wealth over the next decade and beyond… and leave behind a tidy legacy for your loved ones.

Best of all, you don’t need to spend years figuring all this stuff out…

For starters, I’ve outlined everything you need to consider—to take back control over your future—in a brand-new e-book that I’d like to send you with my compliments…

It’s called Retire Up—6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown). And, in it, I’ll walk you through the six key things you can do to protect yourself and grow your wealth.

(Spoiler: You don’t need to do all six… it’s entirely up to you how far you go. Just a couple of these could be enough to save your retirement.)

I’ll tell you exactly how you can get your free copy of my e-book in a moment…

But first, let me introduce myself…

If An Ordinary Guy From Arizona Can Do This, Anyone Can…

And, in case you’re wondering, I’m no fat cat…

Not many people know this about me, but I grew up in a lower middle–class home, the son of a single mother…

There was no trust fund to give me a leg up in life.

I saved long to be able to pay for my first car, and I worked two jobs to cover college tuition… then grad school.

I tell you this to prove the point that you don’t need to be born with a silver spoon in your mouth to take advantage of the kind of wealth-building strategies I’ve followed. The same strategies that I’d like to share with you today…

My journey toward global diversification began 22 years ago when my wife Kathleen and I made our first overseas move to Waterford, Ireland…

During our years on the Emerald Isle, we bought a home, opened bank accounts, ran a business, dealt with immigration officials, filed our taxes on both sides of the pond, and waited in line at public offices more hours than I care to remember…

Seven years on, Irish passports in hand, we were able to move to Paris where we went through the whole shebang again… this time dealing with more onerous red tape…

Four years later, it was the turn of Panama City, Panama… where we found ourselves back at square one… in a country where the mañana attitude is still king.

Today I can tell you that I have:

- Lived and worked in 7 countries on 5 continents…

- Bought and sold real estate in 26 countries…

- Started business ventures in 10 countries…

- Opened multiple foreign bank accounts…

- Acquired a second passport (and am working toward a third)…

I don’t tell you all this to brag… but to show you that—unlike other “offshore experts” you may find out there on the internet—I have real-world, first-hand experience with the offshore world…

It’s my everyday life.

“No Better Source—Don’t Leave Home Without Lief’s Advice!”

“Lief is a valued and trusted advisor to my wife Carolyn and myself. He has been instrumental in providing us with sound advice, excellent investment opportunities, and the best tax information. When it comes to advice from Lief remember the old American Express commercial, ‘Don’t leave home without it.’

“What we learned from Lief was instrumental in assisting us to create a plan for our investments overseas (outside of the United States). Diversification played a major role in our property purchases and investments. All achieved with the aid of sound advice from Lief.

“We do not know of a better source of reliable information of this magnitude. In our opinion, there is no other reliable source with first–hand knowledge and personal experience… Lief says it all.”

liberated expat in Panama

No Matter How Modest Your Assets,

I Can Help You Bump Up Your Wealth

Now I’m the first to admit that I’m an extreme example.

You don’t need to spend decades traveling the four corners of the earth, launching new businesses or flipping real estate..

You can do this on a much simpler scale—whatever you feel comfortable with—and still reap the benefits of offshore diversification.

Ultimately, my mission is to help you secure the wealth you already have. And—if you’re up for it—to put that wealth to work for you. All so you no longer have to worry about what’s coming down the line.

And, there’s one more critical point I’d like to make at this point…

You could say I fell into what others now call “internationalizing your life”…

My first move overseas happened because my wife’s job took us to Ireland. One thing led to another… and, gradually, I started to see how important this journey into offshore diversification was to my family’s future…

In the world we find ourselves today, you can’t afford to wing it like this.

You need a plan… and you need one fast.

It took me two decades to get to the point where I started to feel truly diversified. That’s what happens when you have to figure everything out from scratch…

Now, all that guesswork is removed for you.

Inside, you’ll find the strategies you’ll need to follow to get started on your own wealth-building plan today…

Don’t get me wrong. These things do take time.

But, with my guidance, you’ll be miles ahead of the casual internet browser trying to figure out how the hell he’s going to stretch his retirement dollars in today’s world…

Let me assure you, too, that everything we’re talking about here is 100% legal…

I’ve never done anything to break U.S. law—or the laws of any other country. As much as I love spending time overseas, I want to be able to return to the United States to visit friends and family. By following my lead, you’ll also be able to come and go as you please.

But the strategies you’ll follow will allow you to reduce your tax bill by as much as thousands of dollars a year…

6 Strategies That Can Shape

Your Financial Future

You may be wondering at this point why nobody out there is telling you how to do this… or how the information I’d like to share with you isn’t publicly available…

Think about it for a moment…

Why would Uncle Sam give you instructions on how to move your assets—or generate more income—so it’s outside his own reach?

With a spiraling national debt… and the loom of recession… you can bet that that’s never going to happen in our lifetime…

Did you catch the video that the FDIC released recently? The one where its chairperson Jelena McWilliams said:

“Your money is safe at the banks. The last thing you should be doing is pulling your money out of the banks thinking it’s going to be safer somewhere else.”

Maybe some folks found that reassuring…

I saw it as pure panic.

Because who really loses when you take money out of your U.S. bank?

With interest rates threatening to drop below zero, you know it’s not you.

But I can tell you about plenty of safe places you could think about putting your assets… places where you could see returns in double digits… and where your tax burden could be negligible…

In your free copy of my e-book, Retire Up—6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown), I’ll lay out everything you need to know to get started down the path of true diversification and increased wealth…

It all boils down to these six main strategies.

As I mentioned earlier, you don’t have to go after all six. Not every strategy will make sense for your circumstances. But I’ll reveal the critical information you need to know, so you can make your own choices and design your own diversification plan.

Each of these strategies has its own chapter in my e-book. But, to give you an idea of what you’ll discover, here’s a sneak peek at each one…

Diversification Strategy #1:

Open A Foreign Bank Account (Or Two)

Opening a bank account overseas can be the quickest going-offshore box to check. In this chapter, you’ll find out…

- The number-one thing your offshore bank needs to offer (that will give you quick and easy control)…

- Why you need to have two bank accounts in each place you want to do business…

- Why you should never close a foreign bank account voluntarily…

- 6 top banking options in the world today (including options for private banking… and banks that give mortgages to foreigners)…

- Where you can set up an offshore bank account with a balance of just US$500 (without traveling overseas)…

- Why you should consider this British-made banking haven that most of the world couldn’t point to on a map…

- One of the safest banking havens in the world with the most advanced anti-corruption laws…

Diversification Strategy #2: Protect Yourself With A Backup Residency

If you were to adopt just one of these six strategies, it should be this.

Get yourself a backup residency… and get it as soon as possible.

This is important even if you plan to stay living in the United States…

In this chapter of the e-book, I’ll explain why… and I’ll walk you through…

- One of the world’s friendliest residency programs—North Americans can easily qualify (and work) here…

- This top offshore haven where an investment of just US$25,000 qualifies you for residency…

- 5 top countries to consider for a backup residency…

- The “Gold Standard” in retiree visa programs (with a minimum income requirement of just US$1,000 per month)…

- The European country that gives you a residency visa with a 250,000-euro real estate investment (and permanent residency after five years)…

- Where to get a 10-year renewable visa for you and your family (and up to 80% loan-to-value on buying your qualifying property)…

Diversification Strategy #3:

Second Citizenship

Faced with a lockdown in the future, where would you hang out? Having a second citizenship gives you more options…

And, it’s not that hard to do either. In this chapter, I’ll show you where you can do it in as little as 183 days. And, I’ll introduce you to…

- My top three reasons for getting a second passport…

- Doing the time vs. paying your way—understanding your two routes to citizenship…

- How a second citizenship doesn’t mean you have to renounce your U.S. citizenship (if you don’t want to)…

- Whether you should apply for citizenship on your own or use an attorney…

- 5 top places to acquire citizenship through naturalization (and gain your second passport in as little three years)…

- 4 places to invest for citizenship (a minimum US$100,000 investment qualifies you in two of these jurisdictions)…

Diversification Strategy #4:

Protect Your Assets

Last year, Pittsburgh pensioner Terry Rolin had seized by the DEA.

The guy had no criminal record…

But, in a rush to make her flight, Rolin’s daughter ran out of time to lodge her father’s funds in the bank.

That US$82,000 was made up of the old man’s life savings and inheritance money from his parents—until that day, all stored at home under the mattress.

Stopped by the DEA at the airport, Rolin’s daughter explained the situation. Not satisfied with her story, the DEA seized the lot.

Rolin had to file a lawsuit in order to get his money back.

Now, you probably know better than to carry around this much cash. Or keep tens of thousands under your bed…

But these things can and do happen...

That’s how the U.S. government has racked up more than US$3.2 billion over the last decade… all in cash seizures from ordinary folks…

And all without proof of criminal intent.

But there are many more reasons why safeguarding your assets is crucial in the world we find ourselves today.

In my e-book, I’ll show you…

- What asset protection is… and what it’s not (remember, we’re staying fully compliant)…

- The 7 greatest benefits of taking your assets offshore…

- The 4 biggest risks facing you today (and how to protect yourself)…

- Where to think about planting your asset protection flag…

- Why you need to think “what” before “where” (and keep it simple)…

- Why you should always seek a second opinion (no matter what any expert tells you)…

Diversification Strategy #5—Move Your Business Offshore

Depending on your situation, this could provide huge legal and tax advantages.

Incorporating offshore won’t make sense for everyone. But in this chapter, I’ll fill you in on issues like...

- Why anyone operating a business outside the U.S. should be using an offshore corporation...

- How to qualify for the Foreign Earned Income Exclusion (FEIE)… and potentially eliminate your U.S. tax burden…

- 4 rules for the successful offshore business…

- 3 top places to think about incorporating offshore…

- The world’s best place to set up your internet-based business…

- One haven that offers a wide pool of qualified young English-speaking staff… at a fraction the cost of the United States…

Diversification Strategy #6—Grow Your Wealth Away From The Stock Market

Among all these wealth-building strategies, investing offshore—especially in foreign real estate—is the one that makes me tick…

There’s something about having tangible property in other countries that I find comforting…

You have little—if any—negative impact when the dollar crashes…

And, because your property is in a foreign jurisdiction, courts in the United States can’t touch it.

Best of all, over the last few years, I’ve discovered some of the easiest opportunities for individual investors to break into… on turn-key developments with double-digit returns…

In this chapter, you’ll find out…

- Why having property that generates cash flow is a critical part of any global portfolio…

- Why productive land is the hottest investment right now (you don’t have to lift a finger to reap annual yields as high as 12% to 15%)…

- My favorite opportunities for long- and short-term agriculture plays…

- The long-held secret of the world’s wealthiest people (that’s beaten stock market returns for the past 30 years)…

- How to match your investments to your own comfort level…

- My 5% rule (that’s okay to break now and then)…

This Is Just The Beginning Of Your

Long-Term Wealth-Building Plan…

All the above is just a taste of what you’ll find in Retire Up—6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown)...

Others will pay US$19.95 to secure a copy of this e-book on our bookstore.

But, to help you on your way toward a brighter future, I’m ready to send you a free copy today…

All I ask in return is that you give my Simon Letter subscription service a try…

You see, the e-book is just your first step.

Your circumstances, priorities, goals, cash-flow requirements, and risk tolerance are not the same year after year. And, certainly, not decade after decade of your life...

Meaning that your offshore plan isn’t a set-it-and-forget-it kind of thing.

Don’t get me wrong…

This is nothing like day trading stocks…

You won’t need to take the pulse of your offshore plan every day or even every week or month…

But you should review the pieces of your offshore diversification strategy regularly… and certainly after any big life change.

That’s why I created Simon Letter…

I make it my business to keep up with all the changes in the world’s top offshore jurisdictions and markets.

But I can’t do it alone…

So, I rely on help from my network of globally–spread contacts. And, together, we share our latest findings with Simon Letter subscribers.

So, your free copy of Retire Up—6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown) will give you your grounding in the offshore world…

Then, every month in Simon Letter, you’ll build on your knowledge and identify the opportunities you’d like to act on…

Best of all, you’ll have the contact information at hand for the experts who can help you make it happen.

To give you an idea, here’s just a sample of the topics we recently covered in Simon Letter…

- How to build a bulletproof portfolio—no matter what the market does…

- 7 alternative ways to earn cash flow of up to 25% per year…

- Why investing in coins is one of the best ways to diversify your assets…

- Civil forfeiture of cash—how to avoid it happening to you…

- Why recessions happen and how to profit from them…

- Looking out for grandkids—19 ways to invest for future generations…

- A hydroponic farming opportunity with an annualized return of 16.5%…

- How to multiply your buying power with your 401(k)…

The Future Of Your Nest Egg Hangs On This—Will You Join Me?

Really, the knowledge you’ll tap into inside your monthly Simon Letter is priceless…

It’s the kind of insight and level of detail that you can’t get from your average U.S. financial advisor… or tax attorney.

Either these guys don’t have the knowledge of how to deal in offshore jurisdictions… or it’s not to their advantage to share this information with you.

In other words, Simon Letter is unrivalled.

Here’s What Current Simon Letter

Subscribers Have To Say

“I have subscribed to many newsletters that fall short of the practical information that I need. Simon Letter is everything promised and much more. I do not want to miss even one issue.”

--R.J., United States

You're my favorite newsletter writer. I really enjoy what you put out. Maybe because it never sounds like hype--which I hate!

--A.K., Panama

I like it that you don't try to use scare tactics like some do. Thanks again! You and your wife are doing a great service.

--O.L., Canada

The simplicity of explaining the financial landscape has made your publication a personal favorite read. Thank you!

--C.K., Mexico

Thanks Lief for the valuable information. I really enjoy your articles. They have been very helpful. Wouldn't miss any.

--A.C., United States

Enjoy your letter and the knowledge it imparts. Keep up the good work!

--M.G., United States

I have found this service and staff and of course [Lief] Simon to be extremely helpful.

--T.R., United States

Way to go Lief. Your type of answers and information are exactly what we need. The last letter was really great... Keep up the good work.

--R.F., United States

Start Your Simon Letter Subscription Now

For Just US$7.99!

As I said, Simon Letter will save you countless hours of research and help you avoid costly mistakes…

What you’ll read between its covers could keep thousands of dollars in your pocket… every single year… for the rest of your life.

I could easily charge $1,000 per year for Simon Letter and you’d still be getting a bargain.

But this isn’t strictly about the money for me. Twenty-five years ago, I was in your shoes—I had no idea how much of my modest income was trickling away unnecessarily…

I normally charge US$149 for an annual subscription to Simon Letter. And it’s a bargain at that price…

But, for a limited time, you can access Simon Letter for a full year at only US$97—a 35% savings off the regular price.

That’s just over US$8 a month for real-world, hard-hitting information that can save you thousands of dollars… as early as your next tax bill…

Even better, you can sign up for a 30-day trial today for only US$7.99.

It’s a small investment that will lead to more money in your pocket down the road… whether it goes toward your kids’ or grandkids’ college tuition or to lock down that vacation home of your dreams or whatever else is on your bucket list.

This US$7.99 entry rate is the lowest I’ve ever offered… and I won’t be able to keep it open forever…

I urge to you act now to get your situation in order sooner than later… and, of course, to secure your US$7.99 entry rate…

Here’s What You Need To Do…

Diversifying internationally is the right thing to do…

And I’m the right guy to show you how to get started because I actually live and invest offshore… I speak from experience, not textbook theory.

So, how do you get started?

Everything is automated. Simply click the button below to begin the process.

Once your payment of US$7.99 is complete, you’ll get instant access to the current issue and the free “Retire Up” e-book. On the last Monday of the month, you’ll receive the newest issue of Simon Letter.

Try everything out, risk-free, for 30 days.

If, during the 30-day trial, you are not happy for any reason, just let us know you want to cancel—and you will not be charged anything beyond your initial US$7.99 investment.

Otherwise, if you like the service, simply do nothing. We’ll continue your subscription at an annual rate of US$97; you’ll automatically receive the very next issue of Simon Letter (delivered monthly to your email inbox) and Offshore Living Letter (delivered twice a week to your email inbox).

All you have to do is click the button below to begin…

The process is automated, so you can do so at any time of day or night. It’s simple and secure—and full instructions are provided.

Simply click the button below. You’ll have a chance to review your order before finalizing.

What Do You Want Your Future To Look Like?

The way I see it, you have three options on where to go from here…

You could go back to waiting out these uncertain times… and hope that, when the dust settles, you’ll have at least enough to retire on…

You could try and figure out offshore diversification by yourself…

If you have some time on your hands—and are okay with plowing through legalese and tax code… figuring out the jurisdictions that make the best sense for your circumstances… and tracking down trustworthy, qualified experts to help you—this could work for you…

Or, you could save yourself countless hours… and thousands of dollars… by cutting right to the chase and delving into your free copy of Retire Up—6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown)… and tapping into your (deeply-discounted) monthly issues of Simon Letter.

The choice is yours.

If you truly want to…

- Have the freedom to live where you want…

- Enjoy a comfortable lifestyle for the rest of your years…

- Let your growing nest egg provide for you in the future…

Then I hope you’ll join the ranks of liberated Simon Letter subscribers…

Click below to get instant access to your free e-book—and to start receiving the subscription that will change your future.

I hope you’ll join me… and, together, we can look forward to what can only be more prosperous times ahead…

Sincerely,

Lief Simon

Offshore Investment Guru

Editor, Simon Letter

P.S. Your free copy of my e-book, Retire Up—6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown), is just a couple of clicks away…

Once you join the ranks of Simon Letter subscribers—for only US$7.99 today—you’ll get instant access to this one-of-a-kind introduction on everything you need to know to protect and grow your wealth, come what may…

Along with your e-book, you’ll also get immediate access to the current issue of Simon Letter…

P.P.S. You have enough risk facing you every day. I don’t want to add to that. So, your subscription to Simon Letter comes with my personal Money Back Guarantee.

And, no matter what, you get to keep your free copy of Retire Up—6 Ways To Protect And Grow Your Wealth (Even In Times Of Economic Meltdown) forever. Get the full details on your risk-free subscription when you click below…

or by phone, toll-free from the United States, at 1-888-627-8834.